Please find below the

Finalist Evaluation

Judges'' ratings

| • | Novelty: | |

| • | Feasibility: | |

| • | Impact: | |

| • | Presentation: |

Judges'' comments

The proposal is very well structured and appears clear in the development of the strategy. The importance of the topic made it an attractive choice. At the same time, while the proposal builds upon previous EU efforts in this direction, and aims to address the various barriers that exist towards ZEBs, the author does not provide any information around the costs and challenges of taking this approach. Added specificity would have improved this very proposal.

Semi-Finalist Evaluation

Judges'' ratings

| • | Novelty: | |

| • | Feasibility: | |

| • | Impact: | |

| • | Presentation: |

Judges'' comments

Comment from Judge 1:

Interesting proposal- certainly offers an interesting means of driving ZEB retrofits, while addressing key challenges. I wish the author had been more specific about the countries within EU28 that offer most potential for this idea, as market dynamics will vary. Also, how does this vary from Energiesprong?This part is unclear- Is this proposal positioned as a competitive option to Energiesprong?

Comment from Judge 2:

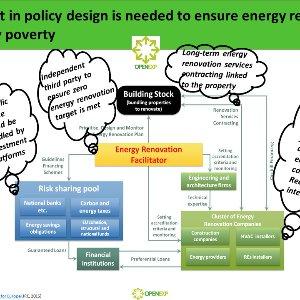

This proposal for ZEB renovation integrates competent and capable supply chains, long term low cost financing and management of perceived risk through linkages to properties instead of individuals. The author identifies some key barriers to ZEB renovation and presents solutions that can address them, based on significant experience in the sector. Implementation involves strong action at the EU level, which may be difficult. But, given the long lives and large numbers of buildings, their impact on climate change is large, and the need to adapt them to changing climate is important.

Additional comments:

Can you be more specific about the countries within EU28 that offer most potential for this idea, as market dynamics will vary? Also, how does this vary from Energiesprong, is this proposal positioned as a competitive option to Energiesprong?

Yamina Saheb Nov 5, 2017 04:40 | Proposal creator Comments from Judge 1: From investment perspective, the first three energy renovation markets in Europe are the German market followed by the Italian and the French one.These three markets accounted in 2015 for almost half of the EU energy renovation market. From policy perspective, the French and the German frameworks are more advanced than the Italian framework in addressing the barriers to energy renovation. Furthermore, Germany and France have developed in the last years the technical capacity needed at local level to support the implementation of the innovative framework we propose. If I was an investor, I would therefore, pick-up, these two countries where the energy transition targets are also among the most ambitious ones in Europe. There are at least two major differences with Energiesprong: 1-Energiesprong has been implemented only for attached family homes, constructed after the 2nd world war and before the implementation of building energy codes in the Netherlands and owned by social housing association. In our case, we provide evidence that the model can be used for all categories of residential buildings, all construction periods and all ownership types. 2-Energiesprong does not fully address the behavioural risk. In fact, occupants receive a full invoice which includes all the costs. In our model, we propose to keep the energy bill separated from other bills to keep overtime the awareness about energy consumption and to limit the rebound effect which may occur in the case of energiesprong. Energiesprong has been for us a good case study to adjust our initial proposal (from 2012). Comments from Judge 2: The EU is already involved in energy renovation projects. The EU support to energy renovation is done through direct financing of energy renovation work using at least two financing mechanisms (the European Structural and Investment Fund and the European Fund for Strategic Investment) but also through capacity building with BuildUp skills initiative and various supports provided to demonstration projects. Furthermore, the Clean Energy for all Europeans Package, released on November 2016, includes an initiative entitled "Smart Finance for Smart Buildings". The initiative proposes to establish investment platforms where EU funds will be bundled and to create one-stop-shops to bundle small projects into larger ones in order to make them bankable. Unfortunately, the Smart Finance for Smart Building Initiative, at least as it is promoted today, does not require bundling all funds including national ones which have a high contribution to triggering energy renovation investment. Also, the proposed one-stop-shops are based on the third party financing models which do not deliver zero energy retrofit because they take at the same time the financial and technical risks. Our analysis of the Smart Finance for Smart Building initiative and how the initiative could evolve to address all the barriers at the same time as proposed by our framework is available on: https://www.openexp.eu/events/smart-finance-smart-buildings There is a video explaining the changes needed to ensure the EU intervention will lead to the market transformation needed to renovation Europe's building stock at zero energy standard.

|