Please find below the

Finalist Evaluation

Judges'' comments

Overall, the main weakness is it imposes a broad tax but concentrates relief to real estate. The increment is also very slow, and wonder how meaningfully this proposal would shift carbon pollution levels.

Semi-Finalist Evaluation

Judges'' ratings

| • | Novelty: | |

| • | Feasibility: | |

| • | Impact: | |

| • | Presentation: |

Judges'' comments

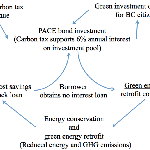

1. Big fan of pace bonds but not sure what it has to do with carbon tax. Is the link that it would reduce interest growth rate on pace bonds to 0? A lot of people want to propose ways to spend the money, the question is does that improve or worsen the chances of a carbon tax/price being enacted? The author should think on this and expand appropriately in the second iteration of his proposal.

2. Author leaves me questioning what an $8 ton carbon tax and capital elicited from issuance of 6% bonds would achieve in terms of carbon emissions reductions. And who is to decide who gets the capital from the bonds? A new federal or state bureaucracy? And is 8$ enough to influence anyone to do anything? Please expand/justify further.

3. This is a well elaborated proposal that builds on existing work. The largest question market is the ambition of the proposal; an 8$ per tonne carbon price is seen by most economists as being insufficient to drive meaningful emissions reductions. How can you justify this number, from the literature, other reports, media, scientific papers, etc.?

No comments have been posted.