Pitch

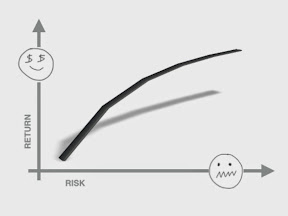

Current financial markets trade-off risk vs. return. We need a third dimension that allows to also trade-off return vs. sustainability.

Description

Summary

The capitalist Ego-nomy has been succesful in driving towards more welfare. But the two-dimensional optimisation of return (greed) vs. risk (fear) has ignored resources use and waste creation. Consequently, planetary boundaries have been (b)reached and action is needed.

The mainstream sustainability movement mainly focuses on implementing governemental and civil society 'corrections' to this capitalist model. The financial and economic machine itself is left untouched. The result is a sequential and separate optimisation of economic and sustainability objectives respectively that is 'bugged' in at least three different ways: It does not trade-off economics and sustainability, it is not effective in reaching maximum welfare and it increases inequality.

This proposal puts forward some principles of a re-design for the financial and economic machine in order to optimise three-dimensionally: return (greed) vs. risk (fear) vs. sustainability (altruism).

A potential mathematical representation of such model would feature a risk/return/sustainability plane, instead of a risk/return curve.

It is argued that current markets can only price risk as effectively as they do, precisely because structural elements (legal frameworks and private market organisation) oblige investors to "push their investments up the risk/return slope". In order to organize the pricing of sustainability as effectively, those structural market elements need to be complemented such that investors can also "slide their investments down the return/sustainability slope".

Category of the action

Changing public perceptions on climate change

What actions do you propose?

The capitalist Ego-nomy drives the world

The capitalist economic and financial system has brought many benefits to mankind. It has proven to be an extremely powerfull system, mainly because at its core it targets individuals rather then society as a whole.

The economy is powered by a very performant engine that is hidden deep in all of us: GREED, i.e. the search for ever more returns/profits. And the relentless engine is directed and kept on the road by the sturdy bodywork that is another deeply human trait: FEAR, i.e. the aversion for risk/losses.

Increasing welfare for all

This capitalist economic and financial system has proven to be tremendously effective in improving living standards.

Societies that embraced capitalism from the beginning - which we now call 'the developed countries' - have reached acceptable living standards for all citizens decades ago already. Other regions are still catching up, but most are advancing each year.

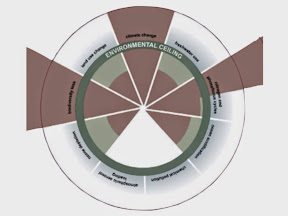

The picture above is taken from Oxfam and Kate Raworth "Living within the Dougnut". It shows welfare achievements for mankind.

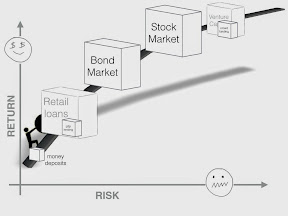

Finance allocated along a two-dimensional curve

The capitalist financial system that allocates resources to projects in the real economy provides for a two-dimensional trade-off, along the same axes of GREED and FEAR as presented above.

But precisely because the trade-off is limited to two dimensions the allocation process ignores other factors - most notably natural ressources used up and waste produced.

Mounting negative side-effects

The negation of ressources used and waste produced (i.e. the so-called 'negative externalities') has also led to us blasting through at least three of the nine planetary boundaries - see research by Johan Rockström of the Stockholm Resilience Centre.

These are boundaries that - according to the scientists - we should respect if we want to preserve the capacity of earth itself to sustain human life in the future!

The picture above is taken from Oxfam and Kate Raworth "Living within the Dougnut". It shows known breaches of the planetary boundaries.

Action has become necessary

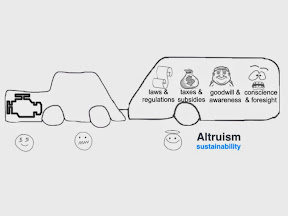

Once awareness has grown that we can not continue on the same course for much longer, the mainstream reaction/attitude wants to keep the efficient engine running ("at least it propels us forward and gives us the means to act!") but it also expects Governement and Civil Society to develop 'corrections', to 'mitigate', to create 'patches' in order to render our growth more sustainable.

In this mainstream approach sustainability thus becomes an add-on ('trailer') to the back of the economic machine ('car'). The trailer is built up out of taxes, subsidies, laws and regulations from governements; of goodwill, awareness, conscience and foresight from civil society. This 'trailer' will make our economies fit-for-life once again.

But for this approach to function, there needs to be a sufficient motivation to make it work ... Does such motivation exist?

There is actually little doubt left that man - next to greed and fear - is also intrinsically motivated by 'ALTRUISM', i.e. the desire to help others without ulterior motives. See also 'References' section below.

So, it isn't too far fetched to believe that human altruism, if we nurture and stimulate it, will prove strong enough to overcome the short-termism of market forces. And, in the end, we simply need to believe that it is, because otherwise all will be lost anyway, right (!)?

Consequently, current efforts to stimulate sustainability are mostly aimed at enlarging, steamlining and optimising this 'trailer' hitched on to our economies. And at first sight it seems logical to expect this approach, if altruism proves strong enough, to help us 'green' our growth.

The system is 'bugged' by design

At closer inspection there seem to be at least three important 'bugs' with this mainstream set-up:

First, the approach is fundamentally sequential, i.e. it treats the economy (= optimal risk/return trade-off) and sustainability separately, the one after the other in quasi isolation. And such 'salami treatment' wil by definition never trade-off economy against climate. Should an optimal solution ever be reached, that would be accidental, not by design.

Second - and even worse - a salami approach does not even guarantee effectiveness in the primary objective of the economy (max profit at acceptable risk) anymore! Indeed, the economic machine will, if uncorrected, always select options that increase profits - even if the profit increase is marginal and irrespective of the environmental impact. So when cleaning-up the environmental damage costs more then the original profit increase - as is often the case - maximum profit after stage 1 does not guarantee maximum profit at the end.

Third, should the additional profits befall a different group of people as the ones that will have to pay for cleaning-up the mess (not unheard of), the salami approach becomes a driver of increasing inequality.

Surely, there must be a better design?

Principles for a re-design

What we need is a system re-design that:

- keeps the good stuff, f.i the ego-power of the capitalist approach

- designs in three dimensions from the start, i.e. that optimises risk vs. return vs. sustainability.

In other words, we need a design that harnesses three strong and tested human emotions: GREED, FEAR and ALTRUISM.

But before designing the third dimension, let's first take a closer look at how the trade-off in the two existing dimensions is organised and what makes it so succesful.

Autopsie of a two-dimensional optimisation

The market structure is set-up to oblige investors to "push investments up the risk/return slope".

In clear language: Every investor starts (by design) with his money on a low risk / low return account. He can then f.i. decide to invest in AAA-rated bonds, which are riskier but also higher yielding. Next, he can then go for lower-rated bonds, again with higher risk and yield. Next are the stockmarkets (general market or small caps). Then - for investors with real deep pockets and high risk appetite - venture capital might be next. Etc.

The important feature of this set-up is that investors must ask themselves at every step whether the increase in expected yield compensates them sufficiently for the increased risk. If not, they will leave their money invested in the lower investment category. This feature ensures that risk is sufficiently remunerated.

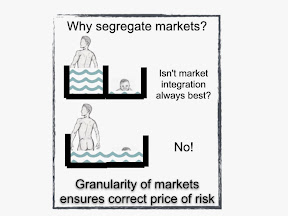

It is essential to grasp that this method is uniquely made possible by the segregation of markets into differentiated asset classes - that are segregated and clearly delineated.

This asset class structure is anchored in our legal framework and completed by the private organisation of markets:

- Imagine simply suppressing the legal provision that gives bonds seniority over shares. The markets of bonds and shares would get 'entangled', i.e. start behaving as one asset class with comparable risk so that investors would require a similar expected return for both.

- Imagine a bond market without reliable info from credit rating agencies. All corporate bonds would be priced in one equilibrium market, leading to mispricing (too high yields for safe bonds, too low for weaker ones). Such 'entangled markets' prohibit the correct pricing of risks.

When markets get 'entangled' this inevitably leads to mispricing of risk, resulting in overinvestment in high-risk assets and shortage of correctly priced funds for more conservative ventures. A bubble will follow that has to correct sooner or later.

Despite occasional hickups, the existing market framework (legal + organisation) seems to functions quite well overall. This should not come as a surprise, because it has grown experimentally and incrementally over the course of centuries. Seniority of bonds over shares f.i. started as a contractual agreement between parties in business ventures. Once this became accepted practice the concept was later anchored legally in most jurisdictions. Credit rating agencies on the other hand grew out of necessity when globalisation made it impossible, even for the most sofisticated investors, to do proprietary credit analysis on all individual issues. Etc. Time has weeded out the non-functional elements.

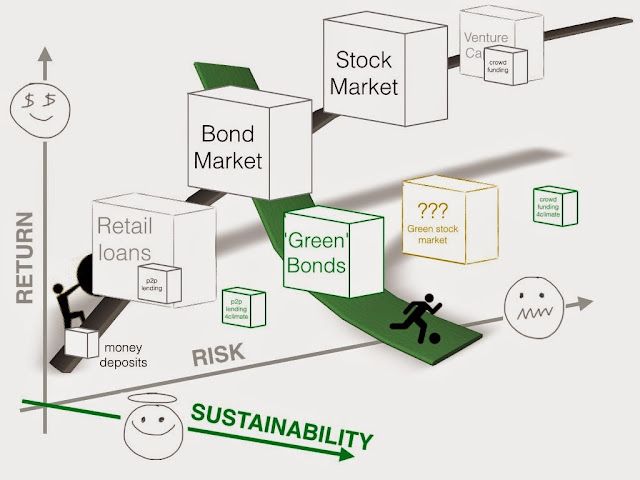

Adding the third dimension

Taking all that precedes in account, we can now theorize about a potential re-design of the financial and economic machine to stimulate sustainability. We want to incorporate, next to greed and fear, the third emotion of altruism. This will be the driver for trading-off return and sustainability, i.e. for correctly pricing sustainability. Or, in other words, we want to create a market structure where investors can "slide down the return/sustainability slope".

Such a market structure would ensure that sustainability gets sufficient advantage.

The good news is this: the first green shoots of new asset classes that embody such a changing market structure are already appearing in the market today. They are mostly spontanous contractual arrangements between parties - much as shares appeared as contracts long before they got a legal definition. The bad news is that these evolutions happen much too slowly. They can/must be given a boost by legislators and/or market structures.

- The most obvious of the new asset classes are so-called 'green bonds'. They are bonds that might offer lower yield then comparable bonds but with added utility of the knowledge that the proceeds of the bond will be used for sustainability ventures/projects. Most green bonds outstanding are still project related and often with substantial involvement or guarantee from governements or development institutions. Although the market is not yet very big or liquid (or standardized), one can easily imagine that this asset class will grow over time (for real liquid markets to develop corporate issues of green bonds will need to grow markedly) and that gradually standardization of practices will occur. Instead of waiting for this process to run its natural course (which took centuries for shares and bonds, remember?), creating a legislative framework early on would be advisable. Also, who will launch the first 'sustainability rating agency' so that reliable gradations of sustainability can be traded-off in the green bond markets?

- In addition, internet based crowdfunding platforms - an approach originally pioneered with the aim of cutting out the middlemen in venture capital - are increasingly being created specifically for 'sustainability' initiatives. Still very low volume and highly unstandardized these initiatives nevertheless hold the promise for developing into the third dimension for venture capital.

- At least one p2p lending platform in Germany focusses exclusively on lending to PMEs for sustainability projects. Again a first kernel of the third dimension in the SME lending space.

An obvious currently unoccupied space is a 'green stock market'. We are not aware of any initiatives of this kind under construction today. On such a market investors would require lower ROE hurdle rates then in the general market, in return for a sustainability dimension to their investment.

- Obviously, on such green stock market early stage green pioneers could get funded earlier then on the general market.

- But also, established green tech companies already competing on the general market could switch to the green stock market, get access to investors with lower ROE requirements and thus immediately (all other things being equal) sell their products or services cheaper. A lower price would then lead to more widespread and faster adoption of the green technologies in society.

- Finally, even companies in traditional (non-green tech) sectors could choose to deviate from the mainstream in their sector and opt for technologies or processes that are less profitable but lighter on the environment, without loosing access to funding.

Who will take these actions?

Governments and regulators:

- create legislation and regulation that establishes the legal basis for "sustainable bonds", "sustainable stocks", etc.

- create (potentially with private partners) sustainability rating agencies that would give corporations and individual bonds a "sustainability rating" that can serve as guide for investors to start "pricing" sustainability (i.o.w. slide down the sustainability slope)

- stimulate private initiatives such as sustainable stockmarket platforms, emissions of sustanable bonds by industry to create volume and liquidity in these markets, etc.

Such public interventions must make the transition towards the third dimension speedier, compared to a natural pace of evolution that could take decades to take shape (cfr. growth of current two dimensions over the last centuries).

Researchers:

To help governments table effective legislation and the right market structure, research is needed into how market structure drives asset allocation. This is a non-existant field of economic research.

Research questions could be (for illustration purposes, non-exhaustive):

- At what level of granularity do additional asset subdivisions stop rendering allocation more efficient? Why? Can we derive a "minimal" allocation unit of risk (or sustainability)? And/or an "optimal" unit?

- When two asset classes "entangle", do investors price risk (or sustainability) at a geometric average level compared to before? Or a volume weighted average? Or do they require an additional risk premium? Or ... ?

- Etc.

Private enterprise:

- emit sustainable bonds, sustainable stocks, etc.

- initiate and/or support sustainability rating agencies - ratings can be subdivided into several categories (or elements) of sustainability such as climate impact, ressources depletion, social support, etc.

- initiate and operate sustainability (stock and bond) market platforms

Investors:

As the third dimension takes shape in the market structures, let their ALTRUISM free rein to put a price on sustainability.

Where will these actions be taken?

Globally : We need these additional market structures worldwide.

They can be introduced per individual jurisdiction, though.

Developed countries should take the lead with signpost "3D market" legislation.

How much will emissions be reduced or sequestered vs. business as usual levels?

Will depend on the timing of the creation of the third dimension, before investors can start pricing sustainability: the quicker the 3D structure is created, the quicker lack of sustainability will be charged a premium.

Will also depend on the "steepness" of the market return/sustainability slope that will materialise (= the market appreciation of the price of sustainability, function of the strength of altruism as an individual motivator).

What are other key benefits?

3D financial markets, given the existence of altruism as an individual motivator, also imply that the "invisible hand" will (help) allocate financial capital to the sustainability transition. Without having to introduce (arbitrary) prices for the commons (EUAs, carbon taxes, etc.)!

What are the proposal’s costs?

No upfront cost necessary.

This only requires a push by legislators and some redirected research funding into the areas mentioned above.

Actions required from private enterprise would be driven by profit motives.

In well functioning 3D financial markets, investors would fund sustainability over time trough avoided/missed extra marginal returns on their investments. The burden of this will - by definition - always be appropriate, since markets (= investors themselves) set the value of sustainability.

Time line

One would hope that the legal framework for sustainability markets (green bonds, green stocks, etc) can be created quickly (= next five years). Governments would also have to stimulate the private sector to create necessary flanking institutions (f.i. sustainability rating agencies), or organise such institutions themselves.

Building the legal frameworks would benefit from economic research on how investor's asset allocation decisions are affected by market structures (currently an underrepresented/non-existant area of research).

Once the third dimension in place ... the invisible hand would create profound changes over the next century, as people's altruism can finally be unleashed next to greed and fear.

Related proposals

References

On the importance of human ALTRUISM as driver of individual choices:

- Kohn (1990) gives the following definition of altruism: "Unconditionally helping others, groups, species and generations".

- The existence of human altruistic behavior has by now been widely validated in research in several of the social sciences (for contemporary research see f.i. N Murtaza; E Fehr; J Abreoni; G B Asheim; L S Carp).

- Interestingly, G Groleau, A Sutan and R Vranceanu conclude in a 2013 paper that altruistic behavior in people is strongest when they feel that future generations are the beneficiaries!

- Note that also the father of capitalism, Adam Smith was no stranger to this concept. He opened his first book with the following lines: “How selfish soever man may be supposed, there are evidently some principles in his nature, which interest him in the fortunes of others, and render their happiness necessary to him, though he derives nothing from it, except the pleasure of seeing it.”

- In the Islamitic culture altruism is fundamentally part of the dogma. Ibrahim Warde writes in 2001 on Islamitic finance: "The most important difference between Homo islamicus and Homo economicus is the assumption of altruism. As with other pre-capitalist systems, Islam is preoccupied with the welfare of a community where every individual behaves altruistically and according to religious norms." And M.N. Siddiqi in a 1972 book mentions several goals of the economic enterprise in Islam, which are: "1. the fulfillment of one's own needs in moderation; 2. meeting the needs of one's family; 3. provision for future contingencies; 4. provision for posterity; 5. social service and contribution to the cause of Allah."