Global 4C: Empowering Humanity for Carbon Transition with Smart Money by crcsolutions.org

Pitch

Global 4C Mitigation: An International Currency Protocol to Protect the Earth's Climate and Biosphere.

Description

Summary

> Includes response to judges

Humanity is stressed by an economic system that facilitates the concentration of wealth, depletion of resources, and the degradation of ecosystems. To mitigate two great environmental threats - climate change and species extinction - we developed a plan called Global 4C for reducing greenhouse pollution. This plan is intended for government consideration in international negotiations on climate and economic policy. It proposes '4C' as a mitigation reward and newly issued currency. The 4C will be offered internationally for GHG emissions reductions, cleaner energy, and sequestration according to rules for net benefit. Bio-sequestration that also protects biodiversity can be rewarded on a statistical basis.

The price signal of 4C will combine with that of co-existent carbon taxes, and so 4C is a macro-economic instrument that creates a stronger mitigation response. Civilization has a bias for energy surplus to maintain economic growth and social stability [6,7]. This plan avoids direct conflict with the politics of growth by offering rewards as a financial incentive. The key advantages for governments will be a new capacity to leverage mitigation by coordinating monetary policy and raising 4C exchange rates. Hence 4C serves multiple purposes: it becomes an international trading currency, it complements co-existent taxes, and it finances mitigation.

The carbon tax is the “price on carbon”, and so 4C will be the "reward for carbon”. 4C is a currency with the technical name Complementary Currencies for Climate Change (4C) and a unit of account of 100 kg CO2-e mitigated or sequestered for at least 100 years (Fig S2). 4C will be issued to enterprises as currency with digital contracts to enforce conditions regarding verifiable duration. Demurrage will be used to account for mitigation defaults. The marginal cost of administration will fall steeply with new technologies for digital communication, networking and environmental sensing.

Category of the Action

Integrated action plan for the world as a whole

What actions do you propose?

The objective is deep de-carbonization to achieve a CO2-e peak of 450 ppm and then sequester to <400 ppm by 2100. Global 4C will achieve this by coordinating a global reward for carbon, reducing political conflict, and providing funds for mitigation, sequestration and data collection. Global 4C will synergy with carbon taxes.

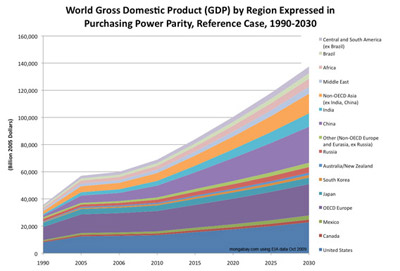

If fossil fuels and forests continue to be the feedstock of growth, then overshooting the 2°C Copenhagen Accord is certain (Fig 1A). Stabilization pathways (RCP4.5 & 6.0) are 'dangerous' (+2.4 to 3°C) and the growth paradigm could bring civilization close to +4°C by 2100 resulting in “… unprecedented heat waves, severe drought, and major floods” [1].

Bill McKibben hopes for a “fundamentally new course” [8] for an early emissions peak (Fig 1B). But a global consensus on carbon taxes is elusive because leaders don’t have economic policies that can leverage mitigation and avoid political conflict with influential groups whose profits and growth are at risk. This is why many politicians prefer growth as opposed to strong carbon taxes: "We seek to deal with (climate change) in a way that will protect and enhance our ability to create jobs and growth” Stephen Harper [9,10].

Policy Framework

G20 governments need an enduring agreement and economic instrument that avoids conflict over costs. Global 4C will meet this need by creating 4C as an international trading currency and GHG mitigation reward.

The goal is to raise the 4C exchange rate during the 21st century to avoid >2°C of warming (Fig 2C). The 4C exchange rate is the price signal for lowering the marginal cost of mitigation (Fig 2A) because each new unit of 4C will be issued to enterprises for each 100 kg of CO2-e mitigated. Hence the 4C supply is physically coupled.

Global 4C offers a paradigm shift in the economy because it

- will enable carbon mitigation similar to debt de-leveraging

- will create positive market feedbacks to fund mitigation

- will create debt-free ethical money

- will lower energy prices

A framework of 4C Councils is proposed to arrange nations by region and conduct negotiations for fiscal commitments (Table 1).

Macro-Economics

- This proposal invites G20 nations to join the 4C currency system shown in Figs J1 & J2.

- 4C is a financial incentive for GHG mitigation that will be issued to enterprises as new currency (Fig J1B).

- The aim is to raise the 4C exchange rate using demand created by national taxes and open markets (Fig J2).

- Reduced government spending and a 4C bull market will fund mitigation & sequestration.

- Least cost mitigation will result according to supply-demand (Fig 2).

- 4C invites country blocks to conduct trade and help mitigation (Fig J3).

- 4C is a market solution that will minimize core inflation caused by de-carbonization (no free lunch).

- 4C intentionally creates monetary inflation to benefit mitigation, but inflation adjusted prices for all other goods and services will only rise relative to mitigation.

Socio-Economic Principles

Polluter Pays Principle (PPP): Polluter pays the social costs of GHG emissions to society as a carbon tax or fee.

Beneficiary Pays Principle (BPP): Society pays the social benefit of GHG mitigation & sequestration to enterprises that mitigate & sequester (4C costs will be diffused across the global economy).

People Cooperate Principle (PCP): A complementary combination of rewards (BPP) and penalties (PPP) will yield the most cooperation from individuals [5] and businesses.

Globalized Intrinsic Value (GIV): Currencies designed to mitigate dangerous global environmental threats (e.g. climate change) deserve international recognition for their intrinsic value.

Micro-Economics

Four classes of 4C rewards will be available to actors in the economy (Fig 3):

(Class 1) carbon intensity reduction rule for heavy industry (Fig J4);

(Class 2) carbon intensity reduction rule for domestic, light industry, transport etc (Fig J4);

(Class 3) cleaner power rule for suppliers in power markets (Fig 7); &

(Class 4) ‘net carbon stored’ and ‘bio-diversity protection’ rules for sequestration (see link).

Detailed calculations are presented for Class 1 & 2 type rewards (Fig J4). Notice how the price signal of the 4C and the carbon tax are additive, but the financial debt imposed by the carbon tax is reduced by the 4C reward. Hence the incentive is aggregated but the enterprise's finances have improved.

Unease may arise if (Class 1) heavy industry can gain twice: by polluting and again by receiving rewards for mitigation. Industry with a history of heavy pollution could have their 4C diverted to Public Trust, but this will depend on a cost-benefit analysis.

To establish a broad user base and test verification, the 4C system may begin with (Class 2) families and (Class 3) power markets. Next, (Class 4) bio-sequestration with improved land-use management in rural communities may be included. Class 4 micro-rewards can be sent by mobile phone and Internet. Rewards will be determined by geo-statistics, ecological modeling and satellite imagery.

Where will these actions be taken?

POLICY STUDY: The study will be international and collaborative because the objective is a new international currency system for mitigation. The current policy host is www.crcsolutions.org, located in NJ, United States, but our team is international, with representation from United States, Holland, Australia, Canada, India, Serbia, Finland and other countries. Sponsorship will be sought internationally. The economic study and a policy white paper for Global 4C Mitigation will be developed collaboratively, but the working language is English.

ADVOCACY: After completing the policy study, we will seek support from climate scientists, economists and policy makers from many nations. Advocacy will then focus on the international institutions and high level officials in the United States, China, European Union, and other G20 nations.

IMPLEMENTATION: For governments to begin Global 4C negotiations, a framework of five 4C host countries and one host institution is suggested. These could be the United States, China, European Union, India, Switzerland, and the United Nations. A starting point for negotiations could be the five-currency system presented in our sub-proposal. This system can be managed and delivered by the host countries (prices of different 4C will tend to equilibrate in a common market).

REWARDS: Class 1, 2, 3 and 4 rewards would be offered to all sponsor nations. Class 4 rewards will be offered for storage of GHG for a period of >100 years and using any lawful technology: BECCS, bio-char, CCS, electrolysis, mineral carbonation, ocean storage, etc. Class 4 rewards will be offered for bio-sequestration in non-sponsor nations, such as in Africa, SE Asia and South America, where significant amounts of GHGs are produced by land degradation, deforestation, logging, fire, mono-agriculture, over grazing, urbanization, desertification, etc.

Who will take these actions?

OUR TEAM: Our team of volunteers includes people at the crcsolutions.org, 8 PhD economists, 1 PhD civil engineer and 3 student interns. The first paper will explain the macro-economic theory and social equity issues as they relate to the use of complementary currencies for correcting market failures in public goods and services. A 100+ page technical report defining the Global 4C Mitigation rules is available to sponsors and partners.

People who can respond to sponsors and partners are listed here: www.g4cm.org, and includes:

Jonathan Cloud (Executive Director) jcloud@crcsolution.org

Center for Regenerative Community Solutions (CRCS) and New Jersey PACE 501c3 non-profit Organization, NJ, United States

Theresa Carbonneau (Strategic Business Consultant) tcarbonneau@mac.com

Delton Chen (Lead Author & Coordinator) g4cm@email.com

Joel van der Beek (Community Sponsor) info@econovision.nl

EconoVision, Economic Research & Advice, The Netherlands

What are key benefits?

GOVERNMENTS: i) ability to leverage mitigation with rewards, ii) currency liquidity in global trade, iii) improved social equity, iv) globalized data capture, v) causality between prices and mitigation, vi) policy longevity, and vii) good governance (Figs 4 & 5).

INDUSTRY: Offered rewards to reduce emissions based on average carbon intensity of operational costs. 4C prices allow long-term planning.

PUBLIC: Social cohesion and investment options (Fig 6). Communities will benefit from bio-sequestration and improved land management. Global 4C creates an education portal & complements other programs.

INVESTORS: Governments will raise 4C prices to meet scientifically determined targets. Market sentiment will follow in tandem and create a bull market. 4C provides micro-finance for projects.

POWER SUPPLIERS: Suppliers are rewarded by the pollution that is avoided (Fig 7). 4C complements any carbon taxes, invites innovation, and does not reward heavy polluters. Rewards sunset at 100% market share.

What are the proposal’s costs?

POLICY STUDY: Economic study is $0.75 -1.0 million USD with private and public partnering.

POLICY ADVOCACY: In kind with partners.

OPERATION: The marginal cost for data collection & verification will fall rapidly with the emergence of the ‘internet of things’.

ABATEMENT: The global abatement cost for de-carbonization to 450 ppm CO2 (<400 ppm by 2100) is roughly 3.1% of GWP (Tyndall Centre, 2006).

MARKETS: A $20 trillion fossil asset write down will occur, and an investment of about $48 trillion will be needed for new energy by 2035.

CONCLUSION: GHG emissions can be globally deleveraged with central bank purchases of 4C over 100 years. This will transfer wealth from the global economy into mitigation and sequestration by diluting the value of fiat. The global economy will be more resilient with fiat, gold and 4C in circulation. The supply of 4C will be 'pegged' to the total mass of CO2-e mitigated and will be absorbed by a growing economy. A long term 4C bull market will be established.

Time line

Presented is a time line for policy development. A fast track might involve parallel projects to develop 4C pilots in various situations.

TIME LINE FOR GLOBAL 4C MITIGATION:

(A) July 2014-Dec 2014: Find sponsors and partners for Global 4C, Launch Website (g4cm.org), Publish Journal Papers defining the 4C Economic Instrument

(B) Jan 2015-Dec 2015: Global 4C Study Commences, Set-up Collaborative Website (g4cm-policy.org), Undertake 4C Macro-Economic Modeling, Undertake 4C Policy Analysis, Undertake 4C Legal and Constitutional Review, Undertake 4C Ethics Review, Direct outreach for political and policy allies.

(C) Jan 2016-Dec 2016: Global 4C Study Continues, Develop Multi-Media Presentations, Publish a 4C Policy White Paper, Present Key Findings (Conferences), Direct outreach for political and policy allies.

(D) Jan 2017: Find Financial & Political Sponsors for Advocacy, Find Policy Custodians, Build Strategic Alliances, Strategy for a bill to Congress.

Sub-proposals

POLICY BARRIERS & SOLUTIONS:

There are communication barriers for Global 4C because "rewards for carbon" are unorthodox, and the 4C system is more complex than the carbon tax. The recommended advocacy pathway is to deliver the policy message to experts in international finance, banking and climate science. Advocacy should highlight that Global 4C has a vision for the 21st century, whereas a total reliance on the carbon tax is risking political delay and policy creep.

Advocacy should also highlight that Global 4C will create an international 4C currency institution that has a better chance of surviving political, social, environmental and economic disruptions. If global warming exceeds 2°C, then such disruptions will be significant and unpredictable.

Gobal 4C may be introduced when there is an obvious need for a 'reset' to the global order. Tipping points could include a financial crisis, a failure of the UNFCCC process, extreme weather disruptions, government scandal, or a military flash point over economic and resource dominance.

Economic modeling and policy studies are needed to assess the efficiency of Global 4C, and to estimate its impact on employment and GDP in various countries.

GLOBAL 4C MITIGATION SUB-PROPOSALS:

We identify three sub-proposals as a priority (1) U.S. price on carbon, (2) settling historical debts, and (3) improving land management for biodiversity and bio-sequestering carbon (as advised by the IPCC).

(1) Global 4C: Empowering Humanity for Carbon Transition with Smart Money

Proposed is a five council architecture for Global 4C negotiations (see Table 1). The U.S. can host the council for the Americas and negotiate contributions for raising the 4C price in foreign exchange markets to mitigate climate change.

(2) Settle the carbon debt and release the power of example!

Developing countries may negotiate joining Global 4C to settle damages by developed countries related to historical emissions. Class 1,2,3 & 4 rewards could be offered to these countries without requiring their sponsorship.

(3) Global 4C: Managing Land for Carbon Sequestration with Smart Money

Pitch: Global 4C advocates a new source of global finance that will reward carbon bio-sequestration and the protection of biodiversity. Category of the action: Land use

CURRENCY INNOVATIONS:

Various Emissions Reduction Currency Systems (ERCS) exist outside the MIT CoLab proposals. Examples include SolarCoin, the ECO as reported by the Club of Rome, and the Ven. Various ERCS financing schemes will be assessed, including carbon titles, promotional discounts, allocations, emission rationing, community currencies, and monetizing credits.

U.S. PRICE ON CARBON:

We also link to (4) fee-and-dividend (F&D) as an important and complementary plan for raising the aggregate price on carbon. The other proposals shown below are promising and synergy with Global 4C.

(4) The Little Engine That Could: Carbon Fee and Dividend

Global 4C is not in competition with the F&D advocated by the Citizens Climate Lobby because mitigation rewards and carbon taxes are complementary. F&D takes from polluters and gives to 'society', and 4C takes from the 'global economy' and gives to enterprises that mitigate and sequester.

The REMI analysis of F&D is promising for employment and GDP in the U.S. The next major step for Global 4C is to undertake economic modeling for the world economy and produce a white paper. Political delays pose the largest uncertainty for forecasting climate change mitigation [17] and so a priority is to assess the political, social, economic and technical feasibility of Global 4C.

Some relevant questions: (a) What is the comparative potential for F&D and Global 4C to be globalized? (b) What are the comparative vulnerabilities of F&D and Global 4C to: i) political opposition by carbon intensive industry, ii) conservative politics over taxes, and iii) infighting over revenue and budgets.

EXAMPLE PROPOSALS THAT SYNERGY:

Global 4C reward rules apply mass balance laws and Kaya formulae to calculate the mass of GHGs to be rewarded for mitigation and sequestration.

(5) Reversing Climate Change with Ocean-healing Seaweed Forests. If this project can verify the net removal of CO2-e from air to reverse ocean acidification and global warming then it would qualify for Class 4 rewards. If biodiversity is improved then a premium would also be rewarded.

(6) Fighting Climate Change and Wildlife Extinction With One Of The Largest Carbon Capture Projects In The World. Reforestation, avoided deforestation and protected biodiversity qualify for Class 4 rewards of Global 4C. 4C micro-rewards would be given to registered locals via their mobile phones (under a pilot project). Geo-social networks will be created. Geo-statistical analysis of satellite images and field data are needed to verify sequestration amounts and assess biodiversity weighting for rewards. Rewards are for net mass with a conditional contract for 100 year safe storage whilst the project is current.

(7) Synergies of Afforestation and Community Empowerment in Kenya. Reforestation would earn Class 4 rewards. At $50 tCO2-e on average, this project would earn about $50,000 per year for 15 years, assuming that carbon is stored for 100 years.

(8) Using Biogas Technology To Improve Sanitation And Mitigate Climate Change. This proposal uses sewage to make biogas and falls under Global 4C's Class 3 for 'cleaner energy in markets' (e.g. Fig 7). The rules require a mass balance of he net GHG emissions and an estimate of the emissions avoided by displacing other energy sources in the market. Fluxes of different gases (CH4, CO2 etc) will to be taken into account.

(9) Woody Agriculture: Breeding & Implementing Hazelnut & Chestnut as Staple Crops. Growing woody crops, agriculture can reduce carbon emissions per operational costs, and so earn rewards under Class 2 of the Global 4C system (Fig 3). Verification would require mapping with time.

(10) Nicaragua: Carbon Sink, Economic Driver & Medicinal Plant Preservation. Similar to (4), reforestation projects on degraded land would be financially rewarded under Class 4 if there is net sequestration. For discrete projects, the rewards and applications can be based on numbers of trees planted (300,000) with the 4C rewards given pro rata over 100 years. Verification would be needed every year or two, and this would encourage tree protection and monitoring.

(11) Spontaneous Conversion of Power Plant CO2 to Dissolved Calcium Bicarbonate. If AWL can capture CO2 from exhaust gases and sequester these, then the process would receive rewards under Class 1 or 2 (industrial) and would likely be commercially implemented as an adjunct to existing industry. It does not qualify as Class 4 because it does not capture from the air.

How do these sub-proposals fit together?

The following sub-proposals fit together in terms of developing the Global 4C policy, undertaking advocacy and implementation. The pilot projects assume that funding is available to run these projects and that they can be used in parallel programs to develop and test the 4C currency and administration systems. This would provide a synergy, as the trial 4C money would be given a notional value as an incentive to communities.

POLICY FEASIBILITY: Information sharing and advice.

(4) The Little Engine That Could: Carbon Fee and Dividend

POLICY ADVOCACY: The currency architecture for negotiations amongst developed and developing countries.

(1) Global 4C: Empowering Humanity for Carbon Transition with Smart Money

(2) Settle the carbon debt and release the power of example!

REVIEW CLASS 1 REWARDS FOR HEAVY POLLUTERS: A social equity and cost-and-benefit analysis.

PILOT PROJECT CLASS 2 REWARDS - REDUCING EMISSIONS INTENSITY: One example in industry and one in agriculture.

(11) Spontaneous Conversion of Power Plant CO2 to Dissolved Calcium Bicarbonate.

(9) Woody Agriculture: Breeding & Implementing Hazelnut & Chestnut as Staple Crops.

PILOT PROJECT CLASS 3 REWARDS - CLEANER ENERGY IN POWER MARKETS: Example in a developing country.

(8) Using Biogas Technology To Improve Sanitation And Mitigate Climate Change.

PILOT PROJECT CLASS 4 REWARDS - SEQUESTRATION: Bio-sequestration and carbon capture and storage (CSS) play a major role in the feasibility of strong mitigation (Weyant et al., 2014; IPCC, 2014b). For this reason, and to protect remaining biodiversity, we focus our attention on averted deforestation and scaling-up bio-sequestration with geo-social networks for financial rewards.

(3) Managing Land for Carbon Sequestration with Smart Money

(10) Nicaragua: Carbon Sink, Economic Driver & Medicinal Plant Preservation.

Explanation of model inputs

EMF27 MODEL INPUTS: Global 4C relies on markets to find least-cost solutions for mitigation and sequestration, and so we do not intentionally pre-select technologies. The objective is to avoid dangerous climate change by creating a price signal in international markets and in remote regions that usually fall outside international markets. For this reason we adopt the EMF27 model inputs for the 450 ppm CO2-e policy and the baseline efficiency to be conservative.

These model inputs assume all no-carbon technologies are available, and this is reasonably consistent with Global 4C, because 4C provides finance for new technologies (i.e. innovation).

Some of the above data are used in a preliminary analysis of 4C currency prices for the period 2015-2100. This analysis assumes that the Global 4C protocol is implemented in 2015, and the 4C reward price is equal to the carbon price for the 450 ppm pathway (RCP2.6). The Kaya Identity was used in the analysis to infer the gross mitigation rate. From this the 4C supply and market value were estimated (see Figs 8 &9).

The analysis sets a lower bound on 4C reward prices assuming that 4C replace taxes (i.e. assuming equivalence). By raising the 4C price the rewards tend to compensate more of the abatement costs. If the 4C rewards increased by factor 10, for example, then they would deleverage a significant portion of the total abatement cost. The degree to which deleveraging could be used depends on the urgency of mitigation and on the carbon tax price (co-existing with the 4C rewards). A combination of taxes and Global 4C rewards should be used to strongly mitigate greenhouse emissions and achieve the 400-450 ppm targets. This approach will be more politically feasible than just relying on taxes.

References

[1] World Bank (2012). Turn Down the Heat: Why a 4°C Warmer World Must be Avoided.

[3] IPCC, 2013: Summary for Policymakers. September, 2013.

[4] PwC (2012). Too late for two degrees? Low carbon economy index 2012. Pricewaterhouse Coopers.

[11] Socrates (470-399 BC). Socratic paradoxes: “No one desires evil”

[18] IPCC, 2014a: Impacts, Adaptation and Vulnerability. Contribution of WG II to the AR5. March, 2014.

[19] IPCC, 2014b: Mitigation of Climate Change. Contribution of WG III to AR5. April, 2014.